Overview of Sage Intacct Salesforce Integration

Sage Intacct Salesforce integration can bring significant improvements to how your business handles both financial and customer data. By connecting Sage’s robust accounting features with Salesforce’s powerful CRM capabilities, businesses can automate workflows, minimize manual tasks, and achieve more accurate, real-time insights. Sage Intacct is part of Sage’s accounting software, designed to help businesses manage finances more easily. It offers tools for tracking income and expenses, managing payments, recording revenue, and creating detailed financial reports.

Insight:

Sage Intacct is the only solution that combines both ERP and hybrid billing, offering a single system to manage revenue, financials, and forecasting. This helps businesses streamline their billing models, speed up the quote-to-cash process by up to 80%, and improve cash flow by as much as 20%.

When you build Sage Salesforce integration, you can combine strong financial tools with powerful customer management features. This integration helps businesses work more efficiently by reducing manual tasks and making it easier to see both financial and customer information in one place, like Salesforce Dynamics integration. It also supports better decision-making and smoother operations.

In this guide, we’ll explore the steps for Salesforce Sage integration, recommend helpful tools from the AppExchange, discuss potential challenges, and outline the associated costs. By the end, you’ll understand how to leverage this integration to enhance both financial and operational efficiency for your business.

- Differences Between Sage Intacct, Sage 100 and Sage 300

- Ways to Integrate Sage with Salesforce

- Top Appexchange Apps for Sage Integration Salesforce

- Apps from Sage Marketplace

- Challenges in Integrating Salesforce with Sage

- Possible Costs of Salesforce and Sage Integration

- FAQs on Sage to Salesforce Integration

- Which Sage products can be integrated with Salesforce?

- What are the benefits of integrating Sage with Salesforce?

- What challenges might arise during the integration?

- How long does it take to integrate Sage with Salesforce?

- Do I need technical expertise to integrate Sage with Salesforce?

- Do I need to maintain the system after the integration?

- Conclusion

Differences Between Sage Intacct, Sage 100 and Sage 300

Before diving into the Sage integration with Salesforce, it’s essential to understand the differences between Sage Intacct, Sage 100 integration with Salesforce, and others, which are part of Sage’s suite of accounting and ERP software, but they target different business sizes and needs, and each has its own integration possibilities with Salesforce.

- Sage Intacct is a cloud-based financial management solution designed for growing businesses. It offers advanced financial features like multi-entity support, real-time reporting, and cloud scalability. Salesforce Sage Intacct integration is ideal for businesses that need powerful financial capabilities along with seamless integration with Salesforce’s CRM.

- Sage Line 50 is primarily aimed at small to medium-sized businesses. It focuses on core accounting tasks like invoicing, payroll, and financial reporting. Salesforce Sage line 50 integration typically involves syncing customer relationship data from Salesforce with financial data from Sage Line 50, enabling sales teams to have access to up-to-date financial information. This integration can help automate workflows, reduce manual data entry, and provide better insights into customer interactions.

- Salesforce Sage 100 integration (also known as Sage mas90 integration Salesforce) is a comprehensive on-premises ERP solution, best suited for small to medium-sized businesses. It focuses on core business functions like accounting, inventory, and manufacturing. Sage 100 Salesforce integration helps automate workflows between the CRM and financial management systems, making it a great choice for companies with simpler needs.

- Salesforce Sage 200 integration is a flexible ERP solution for small and medium businesses, offering advanced tools for managing finances, stock, and operations. With cloud and on-premises options, Salesforce and Sage 200 integration works seamlessly with the system, to enhance efficiency and connect financial and customer data.

- Salesforce Sage 300 integration is an ERP system that caters to mid-sized to larger businesses, especially those with international operations. It provides both cloud and on-premises options and supports multiple currencies and entities. Sage 300 Salesforce integration is suitable for companies managing complex global operations and needing an ERP system that can scale with growth.

- Sage X3 is designed for medium to large enterprises with more complex business processes, particularly those that operate in multiple countries or manage large-scale manufacturing, distribution, or retail operations. Sage x3 Salesforce integration supports advanced functionality for industries such as manufacturing, supply chain, and services.

Understanding the differences between these systems is important because each offers different capabilities and deployment models, which will influence your Sage and Salesforce integration strategy.

Ways to Integrate Sage with Salesforce

There are several methods to Sage Intacct and Salesforce integration. Each one from all salesforce integrations offers unique advantages depending on your business needs and technical resources:

- Official Sage App: Sage provides an official integration app on the Salesforce AppExchange. This app simplifies the integration process by enabling seamless data synchronization between Sage and Salesforce, automating tasks such as syncing financial records, customer information, and invoicing. It provides a quick and easy way to integrate the two systems without extensive customization.

- Custom API Integration: for businesses with complex or highly specific Sage to Salesforce integration needs, a custom API integration can be developed. Both Sage and Salesforce offer APIs that allow developers to build bespoke integrations. This method is highly flexible and can be tailored to meet unique business processes. It requires professional help for implementation and maintenance, ensuring optimal performance and long-term success.

- Third-Party Middleware Solutions: middleware platforms offer pre-built connectors that help to build Salesforce and Sage integration. These tools allow for customized data flow, enabling businesses to automate workflows, integrate various modules (like inventory and orders), and ensure that the two systems work together smoothly.

Setting Up Sage Integration from AppExchange

Making Sage ERP integration with salesforce via the AppExchange is a straightforward process that can streamline your business operations, like Marketo Salesforce integration. Here’s how to get started:

Step 1: Visit AppExchange

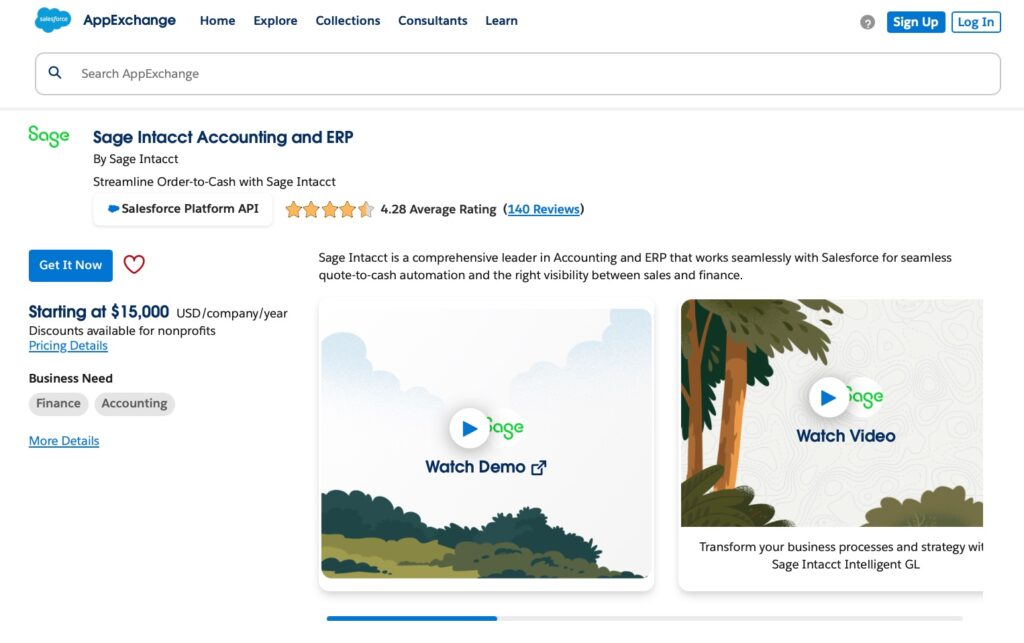

- Go to AppExchange, Salesforce’s marketplace, and search for Sage Intacct Accounting and ERP.

- Click “Get it now”

Step 2: Setting up

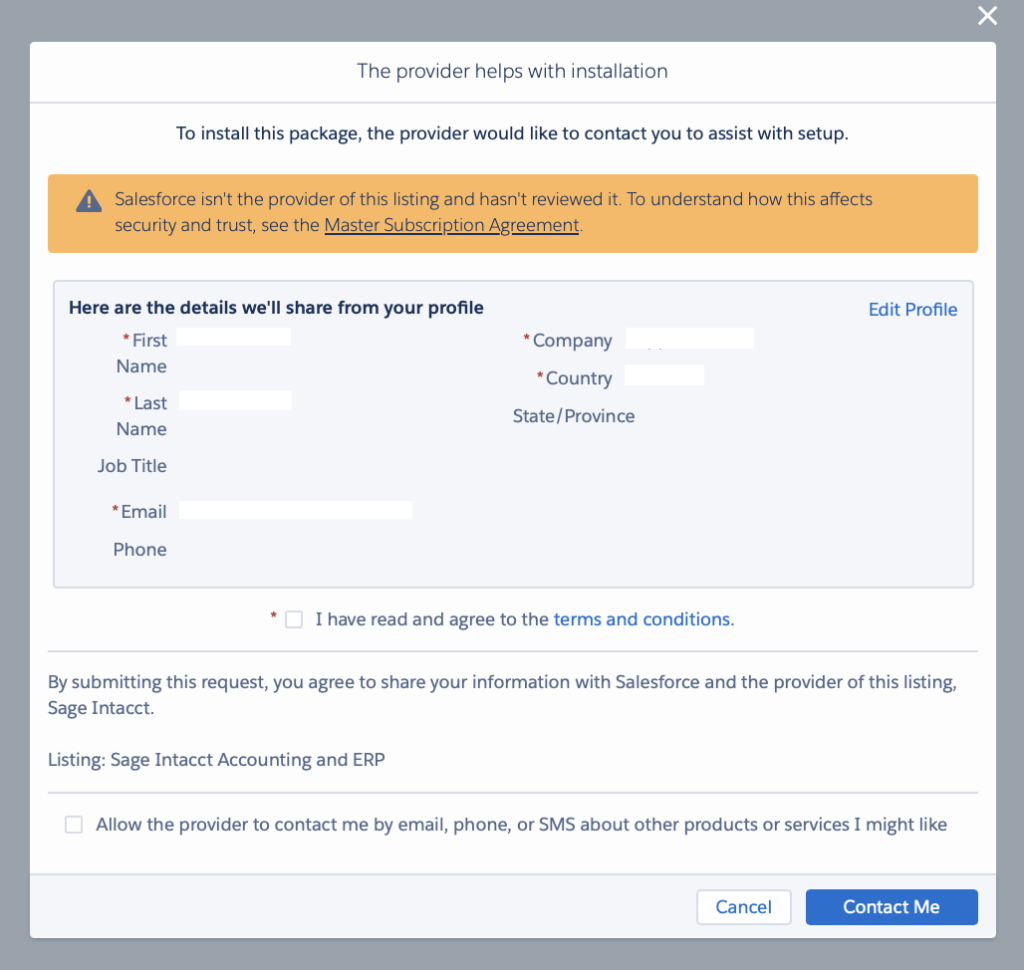

- Follow the prompts to complete the installation process.

Custom Integration with APIs

For a fully customized approach, use Sage Intacct Web Services API and Salesforce REST or SOAP API. For more details check Sage Intacct Salesforce integration documentation.

Step 1: Enable Web Services

- Log in to Sage Intacct as an admin.

- Go to Company → Setup → Web Services Subscription and enable API access.

Step 2: Create a Web Services User

- You might need to set up a new user in Sage Intacct for API integration.

- Assign the role Intacct Web Services User for appropriate permissions.

Step 3: Generate API Credentials

- Obtain the Company ID, User ID, and User Password for API authentication.

Step 4: Prepare Salesforce

- Ensure that Salesforce API access is enabled in your org.

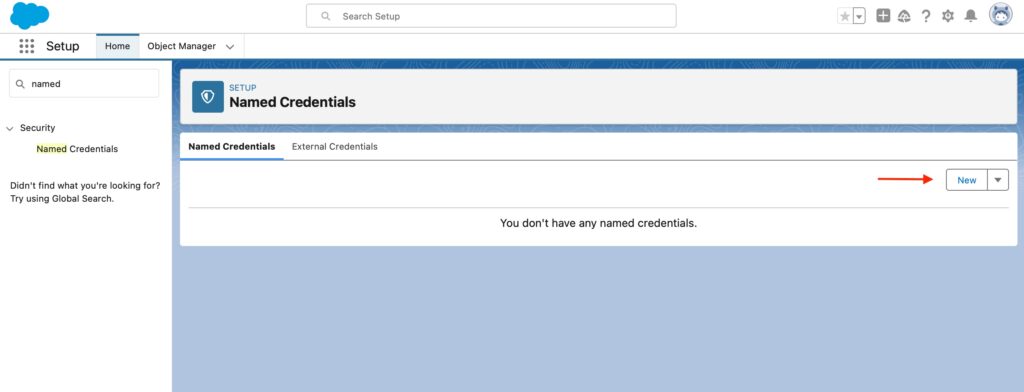

- Set Up Named Credentials: go to Setup → Named Credentials. Create a new Named Credential to securely store Sage Intacct’s API endpoint and credentials.

Step 5: Custom API Integration

- Create Apex Classes for Sage Intacct: write Apex HTTP Callouts to interact with Sage Intacct’s Web Services API.

- Use Named Credentials: reference the Named Credential for secure authentication.

- Define Mapping Logic: map Salesforce objects (e.g., Opportunity) to Sage Intacct objects (e.g., Invoice).

- Set Up Triggers or Flows: trigger API calls on events (e.g., Opportunity stage changes).

- Test API Calls: validate the integration using test records and logs.

Building Sage integration Salesforce by using a custom API is not easy. It requires technical skills to connect the two systems, write code, and make sure data flows correctly and securely. This process can take a lot of time and effort, especially if you’re not familiar with APIs or programming. To save time and avoid potential issues, it’s best to work with professionals who have experience in these types of integrations.

Top Appexchange Apps for Sage Integration Salesforce

Here are recommended apps available on AppExchange that can simplify the process for Salesforce integration with Sage, some of them are great for Salesforce Sage 50 integration and others.

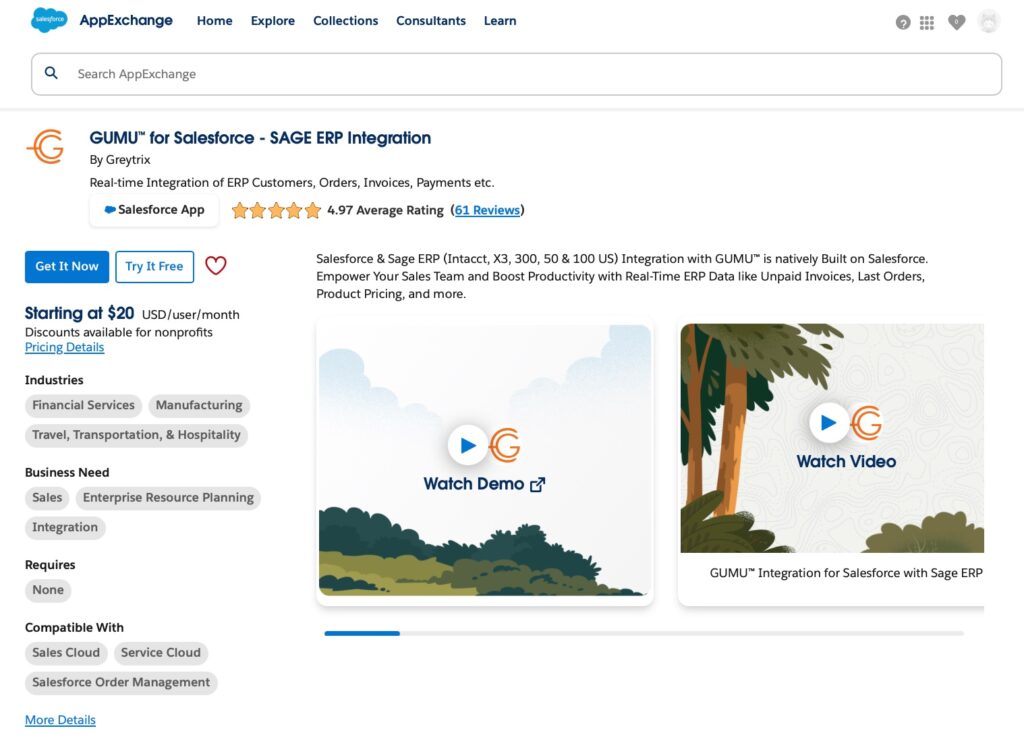

GUMU™ for Salesforce – SAGE ERP Integration

GUMU for Salesforce provides real-time integration between Sage ERP systems (including Salesforce and Sage 50 integration and Salesforce Sage x3 integration) and Salesforce. It allows users to sync customers, last orders, unpaid invoices, payments, and product pricing, empowering sales teams with up-to-date ERP data directly in Salesforce and more. Gumu’s Sage ERP Integration with Salesforce allows previewing data before import, real-time inquiries with flexible configuration and rich data consistency by linking and unlinking customers. Pricing starts at $20 per user per month, with additional setup fees that apply and vary based on your integration requirements.

Sage 100 Sage 50 Sage X3 Sage 300 500 Intacct Integration – SYNC by Commercient

SYNC by Commercient enables seamless Sage Intacct integration with Salesforce, connecting your Sage customers, contacts, orders, and invoices with Salesforce. This no-code solution is designed for fast implementation and robust functionality, eliminating the need for extensive customization. SYNC also supports variations like Sage 50 Salesforce integration and Salesforce Sage 1000 integration, ensuring compatibility with a range of Sage products. Additionally, it integrates smoothly with Salesforce platforms such as Marketing Cloud, B2B Commerce Cloud, and Health Cloud. Pricing starts at $399 USD per company per month, with discounts available for nonprofits.

QXchange by CellarStone, Inc.

QXchange integrates Sage accounting systems (Sage 50/500) with Salesforce, syncing financial data like invoices, orders, and customer details. This eliminates manual data entry, reduces errors, and ensures both sales and finance teams work with accurate, real-time information.

Easy to set up with minimal technical expertise, QXchange streamlines processes like account management, sales tracking, and invoicing directly within Salesforce, improving efficiency and collaboration. Pricing starts from $740 USD/company/year.

Apps from Sage Marketplace

Sage has a marketplace where you can find various apps that help connect Sage products with Salesforce. These apps are designed to make it easier to share data between your financial and customer systems, helping your business run more smoothly. You can explore different options to find the right tools for your integration needs. Here is one app for example:

Solutions Connect: Salesforce & Sage 200 Integration

Solutions Connect offers an easy-to-use Salesforce Sage 200 integration that is available on the Sage Marketplace. It helps automate data syncing between financial records and customer information, reducing manual work and errors. With this integration, businesses can seamlessly manage invoicing, payments, and customer details, making data accessible in real-time. This boosts collaboration between sales and finance teams, improving overall efficiency. Visit the Sage Marketplace for more details on setting up Solutions Connect Salesforce and Sage 200 integration and pricing.

Challenges in Integrating Salesforce with Sage

Challenge #1: Data Accuracy

Ensuring data is accurate between Salesforce and Sage is a common challenge. If the data syncs incorrectly, you may end up with errors, duplicate records, or mismatched financial and customer details. This can affect business decisions and customer service.

Solution: to solve this, use integration tools that can map data correctly and automate the syncing process. Regular checks and audits will also help keep your data accurate across both platforms.

Challenge #2: Inventory Management

Without integration, there can be discrepancies in inventory data between Salesforce and Sage. This can lead to overselling or running out of stock, causing issues with customer orders.

Solution: use an integration tool that updates inventory in real time. This will ensure that sales teams always have accurate stock information, helping prevent overselling and stockouts.

Challenge #3: API Restrictions

Some versions of Sage, like Salesforce – Sage 100 integration or Sage 200, may have limited API access, making it hard to integrate with Salesforce, especially for complex tasks like syncing customer orders or inventory.

Solution: Select an integration platform that works well with your version of Sage. Tools that support advanced API access or act as a middle layer can help connect Salesforce with Sage even when the native APIs are limited

Challenge #4: Real-time Data Syncing

It can be hard to keep data up to date between Salesforce and Sage, especially if there’s a lot of data. Any delay in syncing data can lead to mismatches in sales figures, inventory, or customer information.

Solution: use integration tools that support real-time or near real-time syncing to ensure that both systems are always up to date, improving data accuracy and decision-making.

Challenge #5: Customization Needs

Businesses often have unique workflows for managing their sales and financial processes. Integrating these workflows across Salesforce and Sage can be complicated if the solution isn’t flexible.

Solution: choose an integration platform that allows customization to fit your business’s needs. A flexible tool will let you adjust how data flows between the two systems while keeping the integration simple and easy to manage.

Possible Costs of Salesforce and Sage Integration

The cost of integrating Salesforce with Sage can vary based on the solution you choose, the number of users, and any required customizations.

1. Integration Apps and Licenses

Integration apps from AppExchange or third-party providers can cost anywhere from $399 to $1,000 per month. For example, Commercient’s SYNC service starts at $399/month. In addition to integration apps, you will need licenses for both Sage and Salesforce. Sage licenses range from $3,000 to $5,000 per year for small businesses, while Salesforce licenses start at $25 per user per month.

2. Customization Costs

Customizing the integration to match your business processes could cost $60 to $150 per hour for developers or consultants. If you need significant customization, these costs can add up quickly.

3. Admin Work and Maintenance

Ongoing admin work is necessary to maintain the integration, such as ensuring data accuracy and system syncing. Depending on the complexity, businesses may spend a few hours to several days each month managing the integration, which may require additional costs for internal staff or external help.

Overall, businesses should expect integration costs to range from $2,000 for simple integrations to $10,000 or more annually for more complex setups.

FAQs on Sage to Salesforce Integration

Which Sage products can be integrated with Salesforce?

Salesforce can be integrated with several Sage products, including Sage 100, Sage 300, and Sage Intacct. These integrations allow businesses to synchronize data across accounting, sales, and customer management systems, improving data accuracy and operational efficiency. Tools like Commercient SYNC and QXchange are commonly used for these integrations, and they support various Sage products depending on the business needs.

What are the benefits of integrating Sage with Salesforce?

Integrating Sage with Salesforce helps automate data flow between your financial and customer systems, which reduces errors and manual work. It provides real-time insights and a single view of customer and financial information, improving decision-making and boosting efficiency.

What challenges might arise during the integration?

Common challenges include ensuring that the data between Sage and Salesforce match up correctly, handling system compatibility issues, and customizing the integration to fit specific business needs. Businesses may also face issues with data quality and staff resistance to the changes.

How long does it take to integrate Sage with Salesforce?

It can take from a few weeks to a few months, depending on how simple or complex the integration is. Basic setups are quicker, while more complex integrations that require customizations or third-party tools might take longer.

Do I need technical expertise to integrate Sage with Salesforce?

Some integrations are easy to set up, but more complex ones may need technical help. Hiring a consultant or a developer can ensure that everything is set up properly and works as expected.

Do I need to maintain the system after the integration?

Yes, you’ll need to keep an eye on the integration after it’s set up. This includes making sure systems stay in sync, updating software when necessary, and fixing any problems that come up. Regular maintenance will help the system run smoothly.

Conclusion

Integrating Sage with Salesforce offers businesses a powerful way to streamline operations, connect financial data with customer management, and improve decision-making. By using the right tools, such as apps available on the AppExchange or through other third-party solutions, you can enhance the efficiency of your systems. However, due to the complexity of the integration process, it’s always a good idea to work with professionals who can provide the expertise needed to ensure a seamless and successful integration. Whether you’re integrating Sage 100, Sage Intacct, or Sage 200, expert guidance will help you get the most out of both platforms and unlock their full potential for your business.

Antonina is a Salesforce Admin with five certifications: Salesforce Associate, Salesforce Admin, Salesforce Advanced Admin, AI Associate, and AI Specialist. She started working with Salesforce in 2021 as Intern Salesforce Developer. Now, a 2-Star Ranger on Trailhead, she continues to expand her skills and knowledge. She helps manage Salesforce systems, automate tasks, and improve processes. Antonina loves learning new things and exploring better ways to use technology. In her free time, she enjoys reading, playing sports, and exploring new tech ideas.

Previous Post

Previous Post Next Post

Next Post